- It is time to consolidate important shipments to other markets.

- This is a year in which late producers should not try to get ahead of themselves, because by doing so they will be able to arrive immediately after the Chinese New Year with marketing difficulties, with stored fruit.

Just a few weeks ago, the final reports on cherry exports for the 2021-22 campaign were released and, therefore, exporters and producers also had the trade balance of the season at hand.

While in Curicó in the north it could be said that things are more cheerful, as they managed to get a significant part of the fruit to the Chinese market before February 1, the date on which the Chinese New Year is celebrated, in Curicó in the south the story is different.

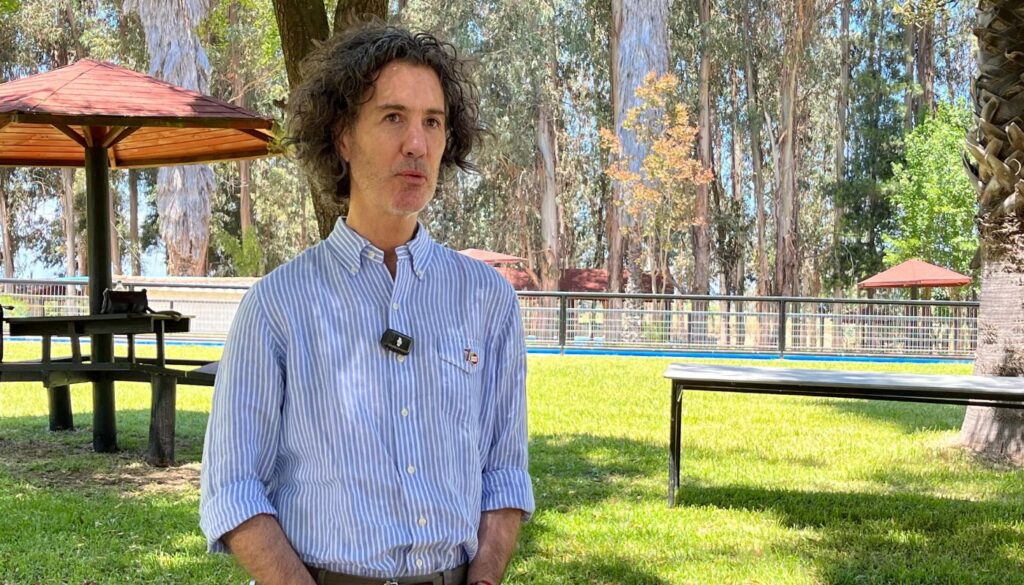

But the recent campaign not only had problems in terms of economic returns, but also in other aspects, and to find out about them we spoke with the Master in Agricultural Economics, MBA Ilades and Agricultural Engineer from the Pontifical Catholic University of Chile, Juan Pablo Subercaseaux. The recent season, the logistical problems, the virus controls and the difficult upcoming campaign, in the following interview.

How do you assess the recent cherry season?

“It was a season that had its complexities, but we were more scared than what actually happened. There was a lot of fear that this new barrier imposed by China with the issue of plant viruses could have resulted in a large number of rejections, export restrictions, which did not happen, they were isolated cases. We must remember that this was a tariff barrier because it has been absolutely proven that plant viruses do not pass to animals and even less to humans, so that generated a lot of uncertainty. The biggest problem is that we had a season with serious logistical problems, high prices, maritime freight prices multiplied by 4 or 5, problems in unloading late fruit, from 30 to 45 days, which is how long the fruit took from when it was loaded in Chile until it reached the Chinese wholesale markets, so it was a year with quite a few complexities, an increase in labor, by more than 30 percent in real terms, but in some ways it could have been worse, the biggest fear was that China could limit the export of cherries to that country.”

In terms of returns, there are many producers who are currently regretting the situation, because although prices were high before the Chinese New Year, after this holiday, the situation became quite complicated. Please tell us about this situation..

“Prices were pretty good until before the Chinese New Year and then they dropped, even deeper than we have traditionally seen. There is always a drop in prices after the CNY, but this year it was particularly abrupt, which hurts late producers and producers in the southern part of Chile. So this year I would say that people who harvested more or less early, up until about December 15th, are doing well, they have good prices, and people who harvested after the 20th, the truth is that they are not in a good situation and in addition, these producers had already had two or three seasons with bad sales.”

Looking ahead to next year, when the Chinese New Year will be celebrated earlier, what will be the scenario that cherry producers will face and the importance of diversifying markets?

“Things get even more serious because the fruit that can be sold before the Chinese New Year is approximately December 10th. It will depend a lot on the times of unloading and things like that. But someone who is producing after December 15th will not make it to the Chinese New Year, in any way, unless they send it by plane, but it will not be able to make it by boat and there will probably be a price drama. So there is a very important point there. The reason why they stopped sending cherries and neglected other markets that do have a high demand for cherries was simply because the prices paid in China were not achieved in Europe, the US or elsewhere, but it must be stressed that there is demand and interest in buying cherries.”

“In the United States there is the capacity to buy a lot of cherries, but at a return price to the producer of USD 2 and the producer sees that in China the return was USD 4, so that meant that the exporter who was interested in reaching its producers with good liquidations, ended up sending almost all the fruit to China and that is why we have 92 percent sent to Asia, China-Hong Kong, and it is for the same reason that diversification is so difficult, because if I can get a producer return of USD 5-6 from an early fruit, it makes little sense to send it to the United States for a return of USD 2, but in the same way, if I know that by sending the fruit to China after the Chinese New Year my expected return is at most USD 2 or less, it would be very interesting to explore other markets, because those other markets will give me those USD 2 and I have where to position the fruit and I will not have that problem of arriving with worse liquidations than if I had sent the fruit to China, particularly this year, where we already know that a fruit with a high yield is not a good return, but it is not a good return, because it is ... Harvested after December 15th will not have a very attractive return; it is the time to consolidate important shipments to other markets, with a price that will be lower than the normal one in China, but that will be equal to or higher than what we could obtain in China this year at that time.”

How do the European and American markets perform in this regard??

“The United States has the advantage of shorter freight times, which means they are also cheaper and have better quality fruit on arrival, but that is a commercial issue. Clearly I have to go where I have the best commercial conditions, but both markets are capable of absorbing very large volumes.”

What is happening with producers in the southern region who have already had two difficult seasons? The one that just passed was even more complicated for them. How is it going or what is planned to be done in the next campaign, considering that the scenario is even more complex due to the Chinese New Year that will be celebrated 10 days earlier than in 2022?

“If we have already had complex seasons, with late fruit and this year the condition is going to be even more complex, I think there are two things that are obvious: one is to look for alternative markets, in which I will not expect to receive USD 4-5, but where they will pay me USD 2-2.5 without a problem, for good fruit that will arrive well and not sending the waste that I did not send to China, but sending good fruit and the second is that I think it is a year in which, eventually, late producers do not try to get ahead because with that they will be able to arrive immediately after the Chinese New Year with marketing difficulties, with stored fruit. I think that the worst thing that can be done, if I am a late producer, is to make too much effort to try to get out early when I cannot get out early and end up in a situation where I will have packing problems, I will have problems with the ship, with labor, of all kinds and I will not make it to the Chinese New Year, so I think that there is an action of sincerity here, each one will have to see how much they can advance their production and if they cannot advance it, it is almost convenient to delay it.

In general terms, looking at the cherry industry, what will happen, considering that some producers are thinking of not producing this year or even tearing up their orchards? Is this a cyclical thing that will pass, will it stabilize or has the cherry industry reached its peak?

“What I can assure you is that what will happen is what has already happened with all the fruit trees that have already lived through this cycle, all the industries and the fruit trees also have the embryonic cycle, of growth, maturity and then comes a stage of decline, what happens is that the cherry tree was in a stage of growth that was incredibly long, I remember in 2001 that there was already talk that we were reaching the maximum production volumes and that we were going to corner the markets, etc., and it continued to grow many times and today we are already reaching the volume that we can work with, in some way the demand is already satisfied, so the only thing that should happen is that we should not have great growth in the plantations, because we will continue to have plantations and renewals in the plantations, varietal, etc., but according to the experts we are between 62 and 68 thousand hectares planted at this minute, I believe that Chile will not go over 70 thousand hectares planted and then it will decline, that figure will decrease and they will start to grow, and the number ... Those who are in more critical weather conditions and with worse production periods are the ones to leave. So, if my production cost is very high because I have to do frost control every year and I am also leaving at a time when the price is not good, I am the first candidate to leave the industry, because instead of making money I am losing. On the other hand, someone who is in an early zone, that does not have frost, that has reasonable production costs, will continue to do very good business with cherries.

Like what happened with the kiwi at the time?

“Of course, this has already happened with kiwifruit. I remember seeing plantations in Quillota and kiwifruit is from the southern area, and since it was very stressed and had a lot of water deficit, they had to put up these nets to prevent evapotranspiration from being so high, etc., so if we analyze the kiwifruit crisis, who were the first to fly? They were the kiwifruit from Quillota, because they had other alternatives that were good and producing this fruit species in that area was very complex, very expensive and really difficult, so it will be adjusted with those who have lower margins, with lower costs and, at the same time, with lower incomes.”