To put the latest cherry season into context and refer to it, it is important to analyze some statistical data, such as the planted area in Chile, total kilos exported, main varieties produced, main destination markets, among others.

Of a total of 376,000 hectares of plants (Fruit Bulletin, Odepa 2023), about 62,000 ha. correspond to cherry trees, which are distributed between the regions of Coquimbo to Aysén, concentrated mainly in O'Higgins and Maule (Fruit Bulletin, Odepa, 2023). Furthermore, it is important to note that, of the total planted area, in the last 10 years, the species that has shown the greatest growth has been cherry trees with more than 48,000 ha planted in this period, followed by hazelnuts (31,000 ha.) and walnuts (29,000 ha.), with a sharp decrease in the area of table grapes, apple trees and kiwis (Fruit Bulletin, Odepa, 2023).

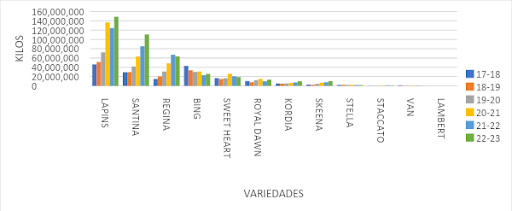

Regarding the main varieties (Chart 1), as in the previous 3 seasons, exports are concentrated in 3: Lapins, Santina and Regina (ASOEX, 2023).

Chart 1: Distribution of the main varieties of cherries exported in the last 6 seasons.

When we want to analyze the export destinations of our fruit, we see that shipments are strongly concentrated in China, with approximately 881 TP3T; followed by the USA (41 TP3T) and in third place is Korea (1.51 TP3T) according to data collected by SAG-ASOEX.

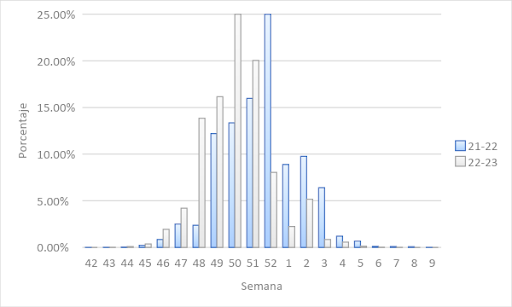

By opening up the information on shipments a little, we can see that of the 100% of cherries exported last season, around 93% were shipped by sea and around 5% were shipped by air (ASOEX, 2023); the season started one week later than the previous one (week 43 vs. 42), as can be seen in Chart 2, generating a large peak in shipments in week 50.

Chart 2: Weekly distribution of cherry shipments over the last 2 seasons.

Moving forward with the analysis of the season, it is important to note that it was marked by at least 5 important milestones, detailed below.

- Accumulation of cold hours (CH)

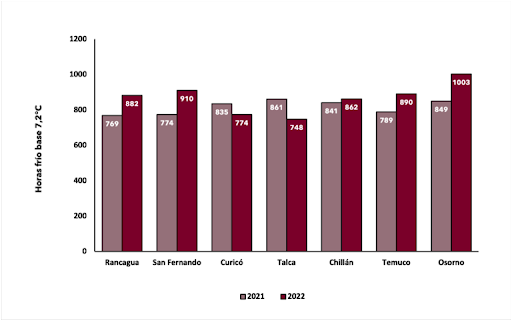

According to data extracted from Smartcherry (Chart 3), the accumulation of HF with a base of 7.2°C during 2022 was greater than that accumulated in 2021, and this allowed, together with the use of dormancy breakers, the orchards to flower early.

Chart 3: HF accumulation based on 7.2°C, for different locations in the central and central-southern areas, last 2 seasons (Avium).

- Degree day accumulation

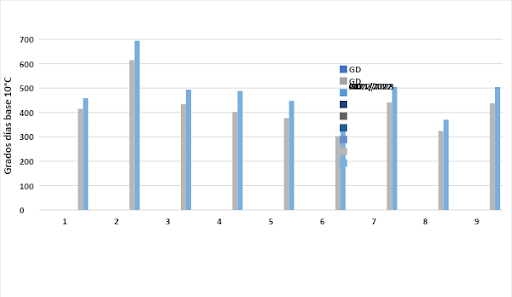

Despite the above, and given that we were coming from a cold winter, the spring of 2022 started somewhat timidly, affecting the accumulation of Degree Days (DG) base 10°C (Graph 4, Agroclimatology Report, FDF, Revista Frutícola December 2022) which are very necessary for the setting and subsequent development of the fruits; this situation generated falls of newly set fruits.

Chart 4: Accumulation of base degree days 10°C in the Valparaíso – Metropolitan and O'Higgins Region, as of November 14.

- Prolonged panic

Regarding what was observed in the orchards, a prolonged fruit bloat phenomenon could be seen, which occurred more markedly in orchards in early, warm areas (Smartcherry 2023).

- Rain at the start of the season

Regarding this spring event, which affected a significant part of the central area of the country, with high intensity (over 20 mm in some locations), it can be noted that it caused significant damage to early varieties, developing cracking problems, thus reducing export yield for some producers (Figure 1).

Figure 1: Development of cracks in early varieties, due to spring rains.

- Chinese New Year (CNY) Date

This milestone is present year after year, taking away the sleep of both producers and packers and exporters since when the ANC is early, we have the challenge, as an industry, of arriving to the Asian giant with a large volume of fruit before this holiday, putting pressure on harvests, processes and shipments; and on the contrary, when the holiday falls late, the challenge arises of prolonging the post-harvest of the fruit, to "make it last" without overripe or ageing. In the last season, where the ANC was on January 22, the challenge was to arrive with the largest volume of fruit before that date and according to the Asoex dispatch statistics, by week 51, 83% of the total volume would have been shipped and this fruit reached the sale before the holiday. For the next season we must focus on the ANC 2024 which corresponds to February 10.

Regarding the logistics situation, it is important to note that this season, although we started with a truckers' strike that fortunately was resolved reasonably quickly, we did not have problems with the availability of truckers to move the loads; regarding the maritime freight rates, these remained high despite the complaints and discontent of the sector, but unlike the previous season there was more supply and availability of containers and chamber vessels, so the reservations of containers per ship could be fulfilled.

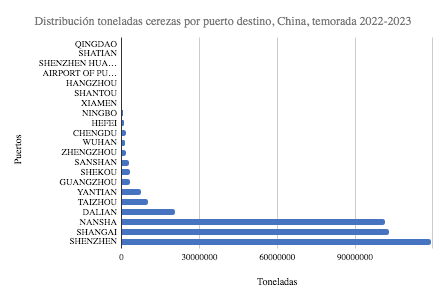

At destination, specifically in China, there were no traffic jams at destination ports as in the previous year, since exporters distributed their cargo to new ports other than Shanghai and Hong Kong, precisely to decongest these two ports (Figure 2; ASOEX 2023); for their part, Chinese authorities prepared to be more efficient in unloading ships and inspecting the fruit.

Figure 2: Distribution of arrivals at different ports in China, 2022-2023 season

All of the above, while important to analyze, we must not forget that the business is ultimately supported by the quality and condition of the fruit upon arrival, which, together with the volume of supply, will determine the sale price.

Regarding this point, in the last season, as we can see in Table 1, the fruit was marked, at harvest, mainly by cracking and rotting in the early varieties (due to the rain at the beginning of the season); lots with a lack of color or light red fruit (Figure 2), due to the anxiety of some producers/exporters to quickly get on the ships and arrive with the fruit before the ANC; the above also caused some lots to present low soluble solids content as well as a small size curve. On arrival, on the other hand, significant levels of fruit with problems associated with mechanical damage could be observed (Figure 3), flavor problems in the lighter fruit and some sensitive fruit, mainly in the Kordia variety.

Table 1: detail of the main problems and damages observed in the fruit, both at harvest and upon arrival at destination (prepared by the author, Trío Kimün).

| Variety | harvest | arrivals |

| Royal Dawn | rain rot | Rotting – pitting |

| Santina | rots, low solids | pitting and bruising, taste problems |

| Lapins | Home red harvests | high incidence of bruises |

| Bing | Lack of color | Bruises |

| Regina | smaller gauge curve | Browning when fruit is left behind, more review |

| Kordia | fruit with firmness problems | most sensitive fruit |

| Sweetheart | bruises | Pitting and bruising |

Figure 2: Clear fruit cv. Bing

Figure 3: mechanical damage cv. Santina

Final comments

Looking to the future, in the short and medium term, difficult but important questions arise to analyze, such as:

- Diversify markets

- Development of new varieties

- Stimulating post-ANC demand

- Further analysis of conservation and travel technologies for late ANC

- Research into disorders, among others.

These and other topics of interest are under constant analysis by the industry, and in order to define the “north” it is important to carry out associative and collaborative work between the different actors, from the nurseries, with the obtaining and offering of new varieties, to the shipping companies, with their appropriate rates and the offer of quality containers; the rest of the cake would be in the hands of the producers with their cultural management in the orchards to ensure a raw material of high quality and condition standards, the processing plants with their operations and appropriate management to ensure the optimal treatment of the fruit and the exporters with their negotiations to ensure the best returns.