India is today a very interesting market for Chilean fruit exports, not only because of its large population of nearly 1.4 billion inhabitants, but also because of its growing middle class, with nearly 350 million potential consumers of imported fruit. Food is the second category, after savings, in which the population invests its income. Monthly, they spend between 12 and 16 percent of their income on food. In addition, India is a market that does not have the production to satisfy domestic consumption, depending on imports.

“India has become one of the fastest growing economies in the world. It is expected to be one of the top three economic powers in the world in the next 10 to 15 years, so this visit is key to prospecting our opportunities and challenges in India, in order to establish a proactive strategy to approach the market and diversify our exports within Asia,” said Iván Marambio, president of ASOEX, who along with other export associations is participating in this “Mission to India” organized by Sofofa and ProChile.

Marambio highlighted that India, in addition, “shows an upward trend in its imports of non-tropical fruits such as apples, oranges, pears, kiwis and cherries, which together have increased from a total of 393,350 tonnes in the 2019-2020 season to 715,792 tonnes in the 2021-2022 season, and where Chile plays a key role as one of the main suppliers of apples, with a share in the total imported of these fruits of 12%, pears 7%, kiwis 25% and cherries 46%.”

He added that Chilean plums represent 101% of imports of this species, table grapes total 51%, and blueberries 131%, respectively.

In India, the Association of Fruit Exporters of Chile (ASOEX), in addition to inaugurating the promotion actions for Chilean kiwis this season, has met with various government authorities in order to improve the conditions of entry of Chilean fruits and advance a bilateral exchange with greater reciprocity. The visit has also included meetings with business groups such as the Confederation of Industries of India, as well as importers and buyers of fruits.

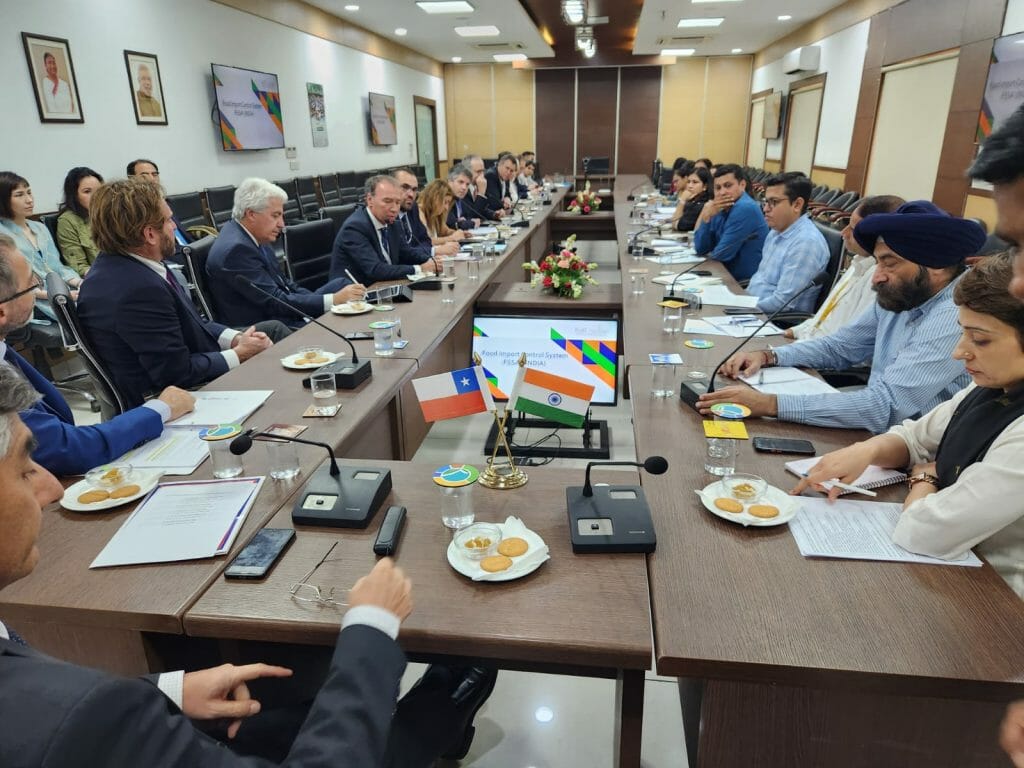

In this regard, Marambio pointed out: “The mission we are carrying out together with Sofofa and ProChile has been very productive. Some of the most important meetings we have held so far have been with the Ministry of Commerce, the Ministry of Agriculture, and the Food Safety and Standards Authority (FSSAI) of the Ministry of Health of India, where we have been able to learn the opinions of the authorities of this country regarding the opportunities to boost Chilean fruit exports, where an approach of mutual benefit and reciprocity has been identified as key to strengthening actions to advance towards the extension of the Partial Scope Agreement between Chile and India, and even towards a Free Trade Agreement. In the case of Chilean fruit exports, in order to achieve greater rapprochement with the Indian market, especially in terms of obtaining better tariffs, the possibility of Indian mangoes being able to access our country was discussed, which would be part of this search for reciprocity in our fruit exchanges.”

With businessmen

During his speech at the Confederation of Indian Industries, Marambio analyzed Chilean fresh fruit exports to India, highlighting that in the 2021-2022 season, these reached 51,434 tons, with the main species being apples (68% of the total) and kiwis with 28%.

A special point highlighted by the leader of the fruit exporters was the tariffs that Chilean fruits face in this market, which prevent greater competitiveness against other suppliers from the southern hemisphere, such as Australia. On table grapes, tariffs reach 24.61 TP3T; apples 501 TP3T, pears 331 TP3T, plums 251 TP3T. While kiwis and blueberries have a tariff of 28.701 TP3T, respectively.

In addition to tariffs, the logistics issue also presents a challenge, as the transit time can sometimes reach nearly 50 days. Added to this is an integrated cold chain and a better distribution chain. “However, we see opportunities where progress can be made, such as the increase in modern distribution, especially online, through e-commerce platforms. Added to this is the growth in consumption in regional cities, as well as the possibility of promoting a combination of maritime transport that reduces transit times,” he said.

He added: “Chile has advantages in India, such as a high market share for key products such as kiwis and cherries, albeit from a very small market base. Chilean export brands are also recognised in the trade as professional and reliable suppliers.”

Wholesale Market

Asoex has also made visits to fruit markets such as the Azadpur wholesale market in New Delhi.The Azadpur market shows a very different dynamic to those we know in other markets within Asia, but where we see a significant consumption of fruit. In India, approximately 901% of its population consumes fruit and vegetables daily, for reasons of religion and health, which leaves our fruits in a very good position, so we are seeking to strengthen our relationships with importers during this visit to the market.” Marambio commented.

Cherries

Claudia Soler, executive director of the Cherry Committee, who is also participating in this visit, pointed out: “This prospecting mission to India seems like a great opportunity to us, since India is a market with great potential to absorb a part of the volumes that go to China. Our shipments are rather incipient with just over 440 tons. However, the import of cherries from India has grown on average by 461 TP3T over the last five years, with the southern hemisphere responsible for 33.71 TP3T of the volume. In addition, India produces a small quantity of cherries that are consumed in the months of August and September, therefore, it does not compete with the Chilean supply.”

Soler added that currently Chilean cherries enter India with a tariff of 0%, “This gives us a significant competitive advantage over our competitors, who may have a 30% tariff. India could become a new China if the challenges facing the market, especially at the logistics level, are overcome.”